Our history

How resilience became a business practice

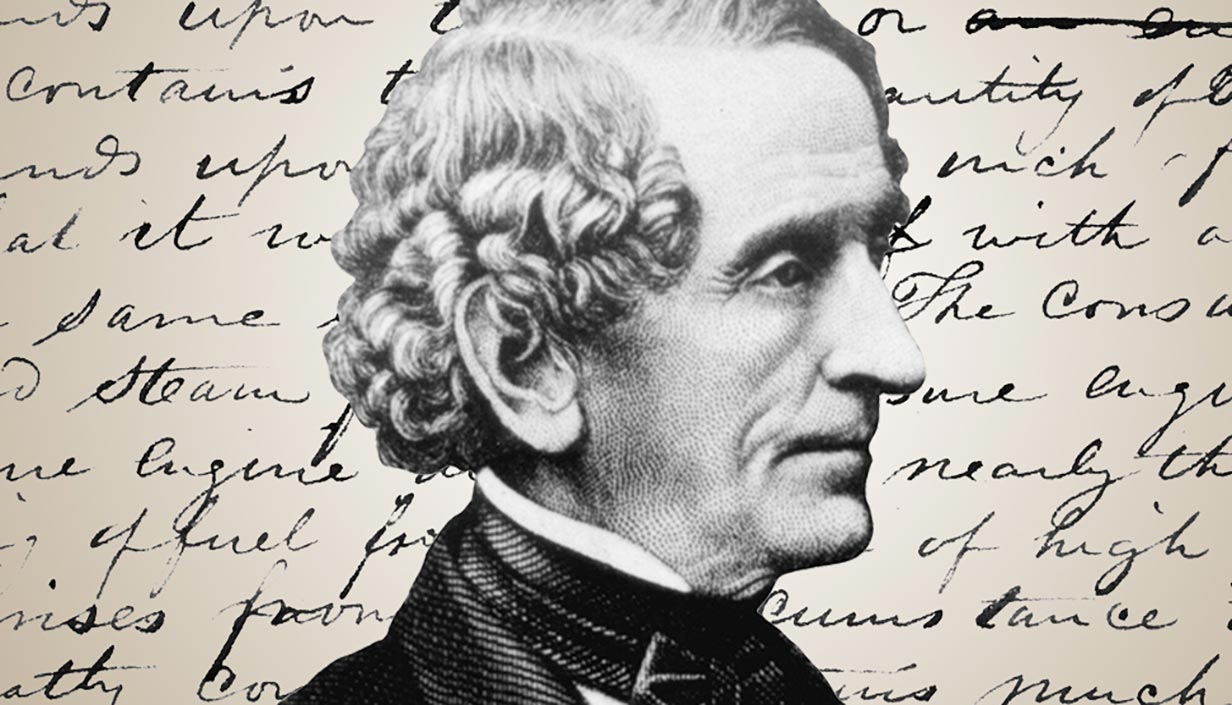

Back in 1835, property loss prevention was not a top-of-mind business issue. That is, if your business was hit by fire, flood or another natural hazard, you rebuilt and hoped for the best. Until a Rhode Island, USA, textile mill owner named Zachariah Allen came along.

Allen, who was also a scientist, lawyer, writer, inventor and civic leader, made property improvements to his mill to minimise the chance of fire loss and increase the mill’s resilience. After taking these steps, he asked his insurance company for a reduced premium. He was turned down.

What happened next changed everything.

Not one to settle for business as usual, Allen recruited other mill owners who shared his loss prevention philosophy. Together, they combined their strength to create a mutual property insurance company that would insure only “good risk” factories—creating the category of “highly protected risk (HPR) properties.” This business idea also provided incentives, because whatever premiums remained at the end of a policy term would be returned to policyholders.

Other companies joined the group, which became known as Factory Mutuals. As Allen had predicted, proper fire prevention methods and inspections resulted in dramatically fewer losses. When the fire sprinkler was introduced in 1874, Factory Mutuals championed its acceptance.

Over the next century, more companies looked to the Factory Mutual System to minimise their property risk, with the knowledge that “the majority of property loss is preventable”. This smarter way, that is, of preventing loss before it happens, resonated with other industries, and more companies across the United States signed on.

By 1987, 42 mutual companies joined forces to become three companies. This merger allowed the three carriers to provide clients more comprehensive coverage and loss prevention resources.

In 1999, those three insurance companies merged to form FM to offer even greater insurance capacity and loss prevention engineering services to client owners.

Following the merger, FM consistently invested in research and engineering, culminating in the opening of the FM Global Research Campus in 2003 -- a US$78-million centre of excellence, designed to help clients stay ahead of ever-changing property risks that could adversely affect their business operations. In 2009, FM broadened the capability of its large-scale fire test laboratory at the Research Campus and designed a new 72,000-square-foot (6,700-square-metre) natural hazards laboratory. To this day, the world-renowned 1,600-acre (648-hectare) Research Campus is the world’s largest and most sophisticated centre for advancing the science of property loss prevention.

FM celebrated its 175th anniversary in 2010 with the company’s mission and focus as contemporary and relevant as the day the company was founded in 1835—reinforcing the enduring nature of the insurer’s business model. The only difference was that the scope of FM's challenges had become vastly greater, as many clients have become more multinational and expanded into new territories where building standards and codes do not always include a focus on facility protection. Moreover, complex global supply chains, driven by cost efficiencies, have led to a much higher risk profile for many enterprises.

Two years later, in 2012, the company created an Asia/Pacific division based in Singapore to support the growth of its mutual policyholders in locations in the Asia/Pacific region.

Then, in 2014, the annual FM Resilience Index was launched, the first data-driven tool to rank 130 countries and territories around the world according to the resilience of their business environments.

In 2016, FM was named one of “America’s Best Employers” by Forbes magazine.

The following year, FM established a new insurance company in Luxembourg, FM Insurance Europe S.A., to continue delivering seamless insurance coverage to its policyholders throughout the European Economic Area (EEA).

Always looking for new ways to help policyholders become more resilient, in 2017 the company opened the FM Science and Technology Center, Americas, a new US$15 million, state-of-the-art facility in Norwood, Massachusetts, USA. In the 27,000-square-foot (2,500-square-meter) facility, employees and clients explore property-loss prevention and insurance-related training through active learning classrooms, 12 experiential SimZone Labs, and a warehouse and data center designed to replicate clients’ properties.

A year later, FM opened a US$16 million Electrical Hazards and Gas Detection Laboratory at its Research Campus, following nearly two years of construction.

FM constructed a second SimZone in Singapore to bring property loss prevention through experiential learning to the Asia/Pacific region. Officially opened in November 2022, the FM Science and Technology Centre, Asia Pacific offers hands-on learning laboratories, and is the first of its kind on the continent of Asia.

Today, FM continues to lead the field as one of the world’s largest commercial property insurance companies, insuring one of every three Fortune 1000 companies and similarly sized organizations worldwide that work with the company to better engineer resilience into every corner of their businesses.

If the company’s history is any indication of its future, FM will continue to invest in research and technology to speed the transfer of knowledge into client-focused loss prevention solutions. Additionally, the company will continue to accelerate its time to market with new products and services that meet clients’ evolving property protection needs.

More to come...